Carrera 23 No. 26-60

Ed. Cámara de Comercio de Manizales por Caldas

(+57) 606 884 1840 ext. 503

[email protected]

Create innovative and more profitable products in the company of BIOS.

Discovery of new drugs based in universities or laboratories, up to small-scale production plants Agroindustry

Coffee Airport: USD $132 million, runway of 1,460 meters, regional range, day and night operation.

Miel Hydroelectric Project 2: USD 250 million, 120 megawatts, water edge.

Agropark kilometer 41: Research center, business development, 56km from Aerocafé.

La Dorada multimodal platform: 120 hectares, 67 thousand tons (year 1), Chiriguana railway line (555km).

The Manizales Tourism Cluster articulates institutions, companies, and other stakeholders in the sector.

Caldas, part of the declaration of the Coffee Cultural Landscape-PCC as a Cultural Heritage of Humanity by UNESCO in 2011.

The Best Value City Index, published by Trivago Colombia, links the most recommended destinations for travel 2019. Manizales ranked third in Colombia and fifth at the South American level.

52% average hotel occupancy.

9% increase in visits by non-resident foreigners.

Manage an international hotel chain's arrival such as the ibis, Hampton by Hilton, or Holiday Inn in the department to attract new international visitors to the region.

8 microclimates and 4 thermal floors ideal for growing a wide variety of fruits and vegetables.

Fertile soils and rainfall with an average of 1,871 millimeters per year.

12,446 graduates associated with the Agro-industrial sector among technicians, technologists, professionals and specialists.

Important university offers, generating R+D+I, from the growing phase to raw material and value-added transformation processes.

It can reach USD 300 million for Hass avocado exports and planting 20,000 hectares.

Attraction of a whey processing plant from the dairy industry taking advantage of the strategic location of La Dorada in the center of the main dairy areas of the country.

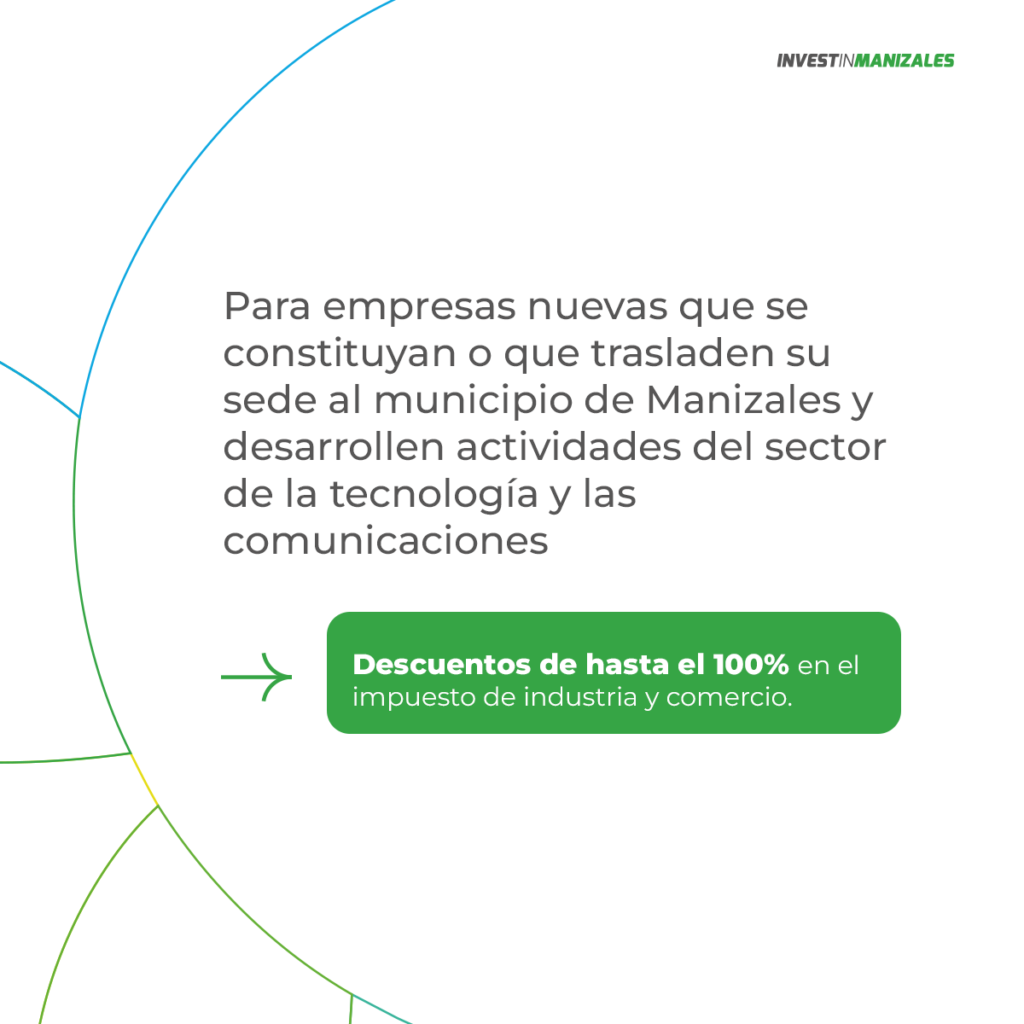

134 companies in the ICT sector, of which 3 are certified in CMMI Level III and 8 in IT Mark.

134 companies in the ICT sector, of which 3 are certified in CMMI Level III and 8 in IT Mark.

7,204 graduates associated with the sector.

Manizales currently accounts for 13% of the industry across the country.

Manizales currently accounts for 13% of the industry across the country.

Consolidated ICT Ecosystem.

Colombia's ICT Ministry has invested $13 million in Manizales and Caldas in the IT sector over the past two years

Agritech

Foodtech

Software and digital technologies: Software development, animation, automation, data centers.

BPO / KPO : Shared services with high specialization.